3 Simple Techniques For 11 Ways I Paid Off $80,000 Of Debt---in Just 3 Years

That added time will certainly cost you extra in passion fees. While the financial debt snowball as well as avalanche are two overarching methods for just how to pay off debt, here are some specific strategies you can use combined with them. When you have charge card debt, one option is to move your credit rating card equilibrium to a various card.

This resembles repaying one bank card using another card. A lower-rate equilibrium transfer card can fit well with the avalanche approach. Considering that you can use a balance transfer to tactically minimize the rate of interest on your highest-interest financial debt, it can get you time to concentrate on the next-highest interest account.

Several equilibrium transfer credit rating cards even supply a 0% APR for an introductory period (often 6-18 months). A 0% APR offer allows you an opportunity to repay your bank card balance without incurring extra rate of interest fees. Say you have $6,000 of charge card financial debt at an 18% APR. You can move that balance to a card that supplies a 0% APR for 12 months.

You'll possibly need to pay a balance transfer cost, so make certain to run the numbers and also check out the great print up front. Yet a few bank card supply 0% APR balance transfers and also charge no balance transfer charges. If you contend the very least good credit report, you may have the ability to qualify for a good balance transfer bargain.

The Ultimate Guide To 8 Ways To Get Out Of Debt In 2020 - Credit.com

Repaying charge card debt outright is normally the most intelligent monetary technique. Yet, if you're in so much credit scores card financial obligation that you can not pay for to just compose a big check as well as the financial debt avalanche method seems as well overwhelming or slow to handle, it could be time to take into consideration a different technique.

The benefits of this route include: Since a personal funding is an installation funding, its balance-to-limit ratio doesn't harm your credit history the means rotating accounts (like bank card) might. So, settling your charge card debt with an installment funding could significantly enhance your debt, particularly if you don't currently have any type of installation fundings on your credit rating records.

Individual funding rate of interest are often lower than bank card rate of interest. If you qualify for an installation finance with a lower price, you'll wind up paying much less cash in general. That being claimed, securing a lending to settle charge card financial debt can likewise threaten. Comply with the regards to the finance very carefully, or you could just make your scenario worse.

Or else, you might wind up better in financial obligation. If you use this approach, keep in mind these bottom lines: Do not shut the charge card you settle, unless they have annual costs you don't want to pay. Keep them available to help your credit history usage. Don't spend any kind of more cash on your paid-off bank card.

The Ultimate Guide To How To Get Out Of Debt On Your Own: A Diy Guide

Make routine, punctual payments on your installment car loan. If you do not, you'll just produce even more issues for your credit report - Pay off debt fast. There are numerous locations to seek personal finances with a wide array of prices depending on the lender as well as your credit rating. You might wish to talk to local banks and cooperative credit union where you already have an account.

A personal financing can affect your credit rating in a number of means. Whether the account eventually harms or aids you depends upon 2 main variables exactly how you take care of the account as well as the rest of the info on your credit scores reports. The application could hurt your scores. When you use for credit scores, a questions is included in your credit history records.

Your ratings could enhance as your individual car loan ages. At initially, a brand-new account might minimize your ordinary age of credit as well as negatively impact your ratings. As your individual car loan expands older, it can help those numbers. A personal financing could lower your debt application. Personal financings are installment lendings, which don't affect your revolving use proportion at all.

If you pay off bank card with an individual financing, your rotating application proportion should decrease, and also your ratings might boost. Your credit rating mix may boost with a personal lending. Scoring models reward you for having a diverse mixture of accounts on your credit report records. If you don't have any type of installment loans on your reports, including an individual financing could aid your ratings.

How Debt Avalanche Vs. Debt Snowball: What's The Difference? can Save You Time, Stress, and Money.

Simply make sure you make every payment on time. If you open up a personal lending and pay it late, it can damage your ratings dramatically. Show moreShow less Debt negotiation is one more alternative you can think about when you're ready to eliminate your charge card debt. This approach typically functions finest for individuals who (a) are currently past-due on their charge card payments and also (b) can afford to make huge, single settlement payments to their financial institutions.

You may be qualified if you've undertaken hardships like work loss, medical issues, or separation. However, some financial institutions will think about resolving financial obligations also if you do not have any special extenuating conditions. You may, however, have to pay tax obligations on the forgiven amount. You can work out financial obligations by yourself or you can employ a specialist debt settlement business to take care of the process for you.

Learn what to keep an eye out for at the FTC Consumer Info web site. When you have actually reached your limits and have nowhere else to transform, personal bankruptcy can offer a clean slate. You ought to only utilize it as a last hope, nonetheless, because bankruptcy can devastate your credit history. There are 2 sorts of personal bankruptcy:, which typically requires you to surrender a few of your residential property, which permits you to maintain your building Proclaiming either kind of personal bankruptcy can be a long, pricey procedure consisting of lawyer and also court declaring fees and you should not take it gently.

When you're swimming in red-letter costs as well as pestering telephone call, it can commonly really feel like there's no chance out. However by utilizing the techniques above, you can eventually free on your own from the irons of financial debt.

Little Known Facts About 9 Ways To Pay Off Debt - The Motley Fool.

Make use of these devices to get your debt-free day and also discover a payoff course. After that, register with NerdWallet to track your financial debts as well as see upcoming payments.

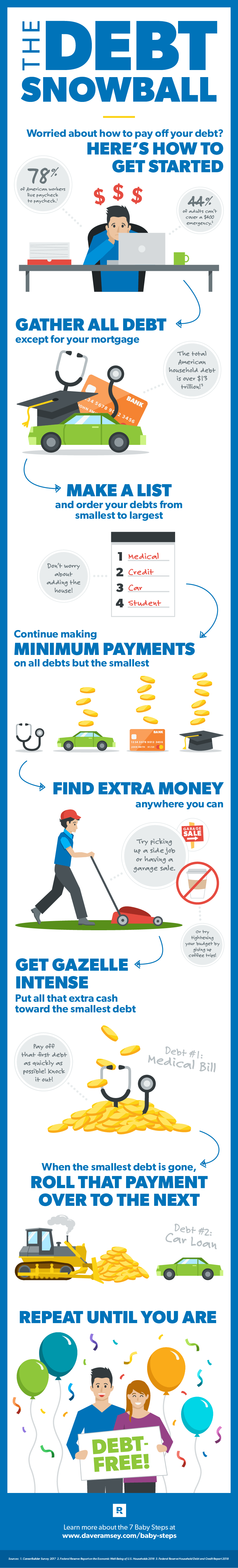

If you owe cash on trainee car loans, auto loan and also credit score card expenses, you're not alone. The current numbers from the Federal Get show that the complete national household financial obligation stands at $13.54 trillion.(1) That's trillion with a "T. Debt relief." And also based on those numbers, it's secure to state that bothering with financial debt is a national epidemic.

Financial debt is as American as apple pie, however you recognize as well as we do that it doesn't taste as pleasant. If you stick with us, we'll reveal you just how to settle financial debt as well as remain out of debt completely. Anything owed to someone else is thought about debtyep, that also includes trainee loans as well as vehicle loan.

Those are simply variable monthly costs. The very same goes for things like insurance policy, tax obligations, groceries and childcare expenses. Non-mortgage financial debt consists of: student fundings vehicle loan charge card medical debt house equity finances cash advances personal finances Internal Revenue Service and also national debt Now, how you pay for these costs can develop into financial obligation.

book now